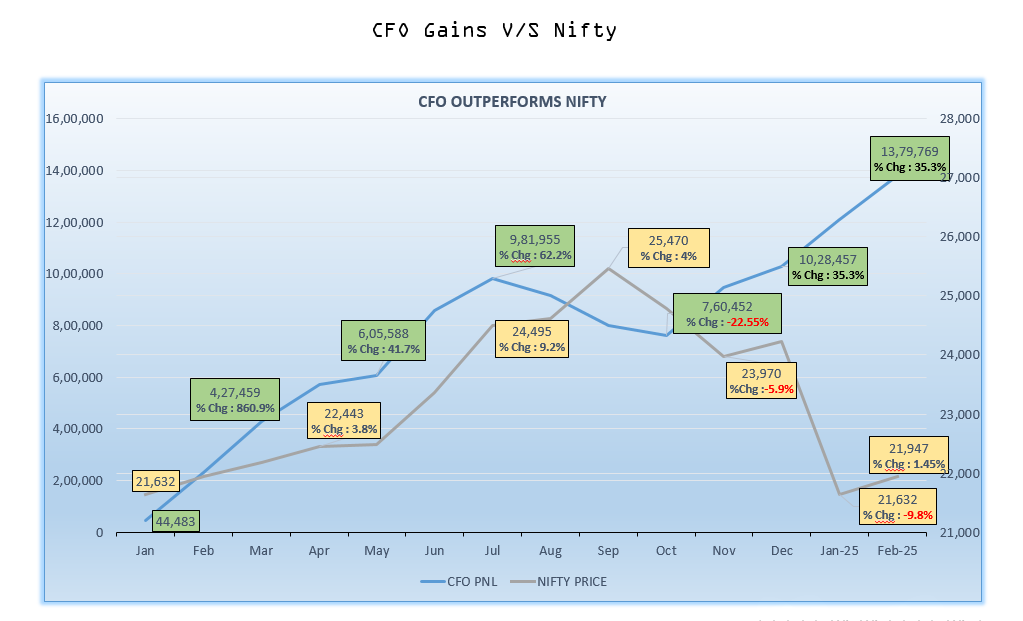

CFO GainsOut Performs Nifty

Strategies for CFO Gains

Cash

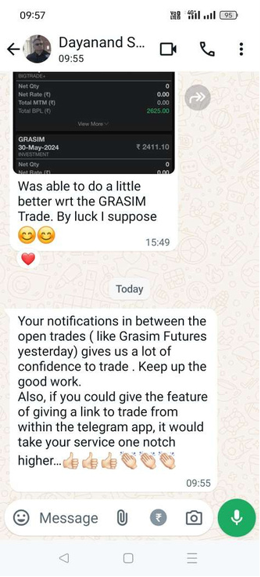

The futures market is highly volume-driven, making it well-suited for short-term and intraday trading. Trades are initiated based on real-time volume analysis and executed using technical setups such as price action, momentum indicators, and volatility-based strategies to capitalize on market movements efficiently.

Futures

The futures market is highly volume-driven, making it well-suited for short-term and intraday trading. Trades are initiated based on real-time volume analysis and executed using technical setups such as price action, momentum indicators, and volatility-based strategies to capitalize on market movements efficiently.

Options

The futures market is highly volume-driven, making it well-suited for short-term and intraday trading. Trades are initiated based on real-time volume analysis and executed using technical setups such as price action, momentum indicators, and volatility-based strategies to capitalize on market movements efficiently.

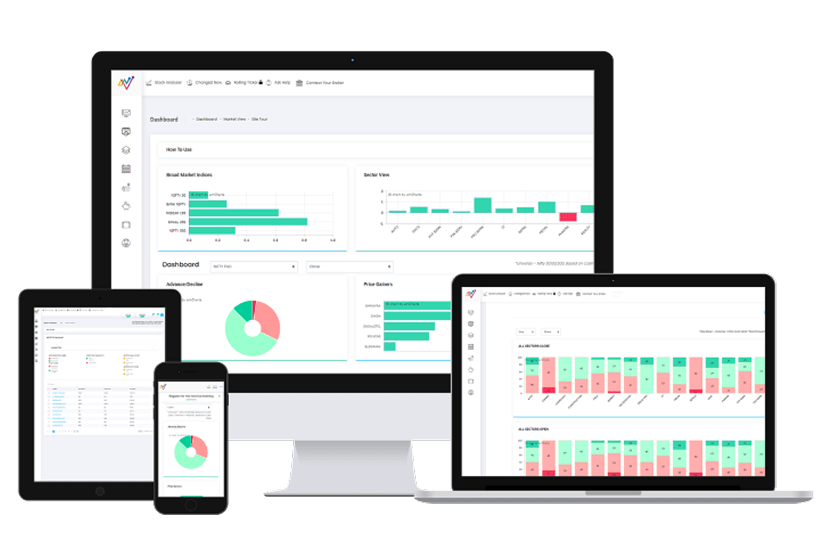

Access Trades Across Multiple

Timeframes just at Rs. 125* per day

*

Effective Annual Pricing (₹35,400 annually)

CFO Uniqueness

- CFO is a SEBI-registered advisory with expert analysts using Neo Trader.

- We offer Cash, Futures, and Options trades for intraday and multi-day strategies.

- CFO is a powerful advisory service that can help housewives, working professionals and businessmen access the market.

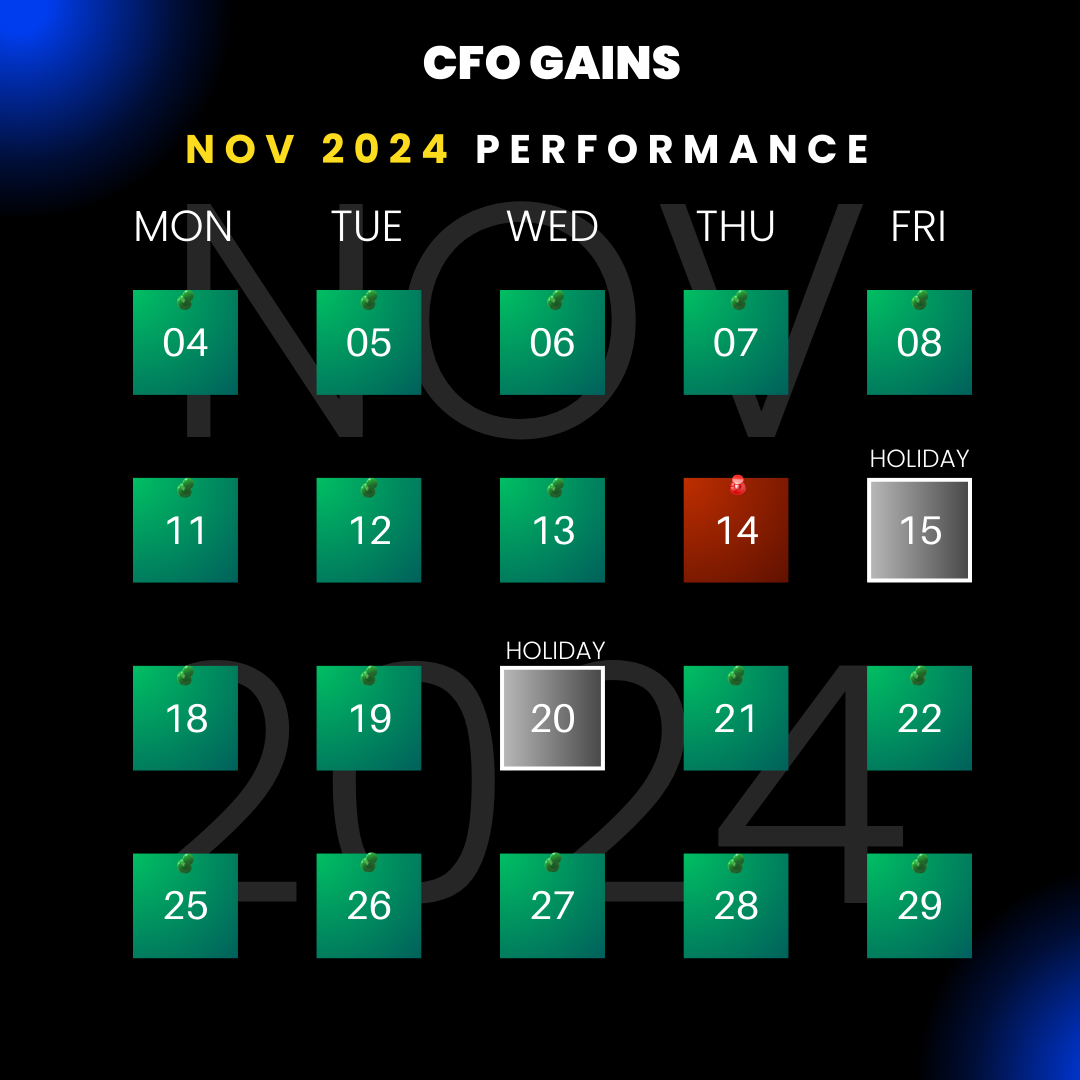

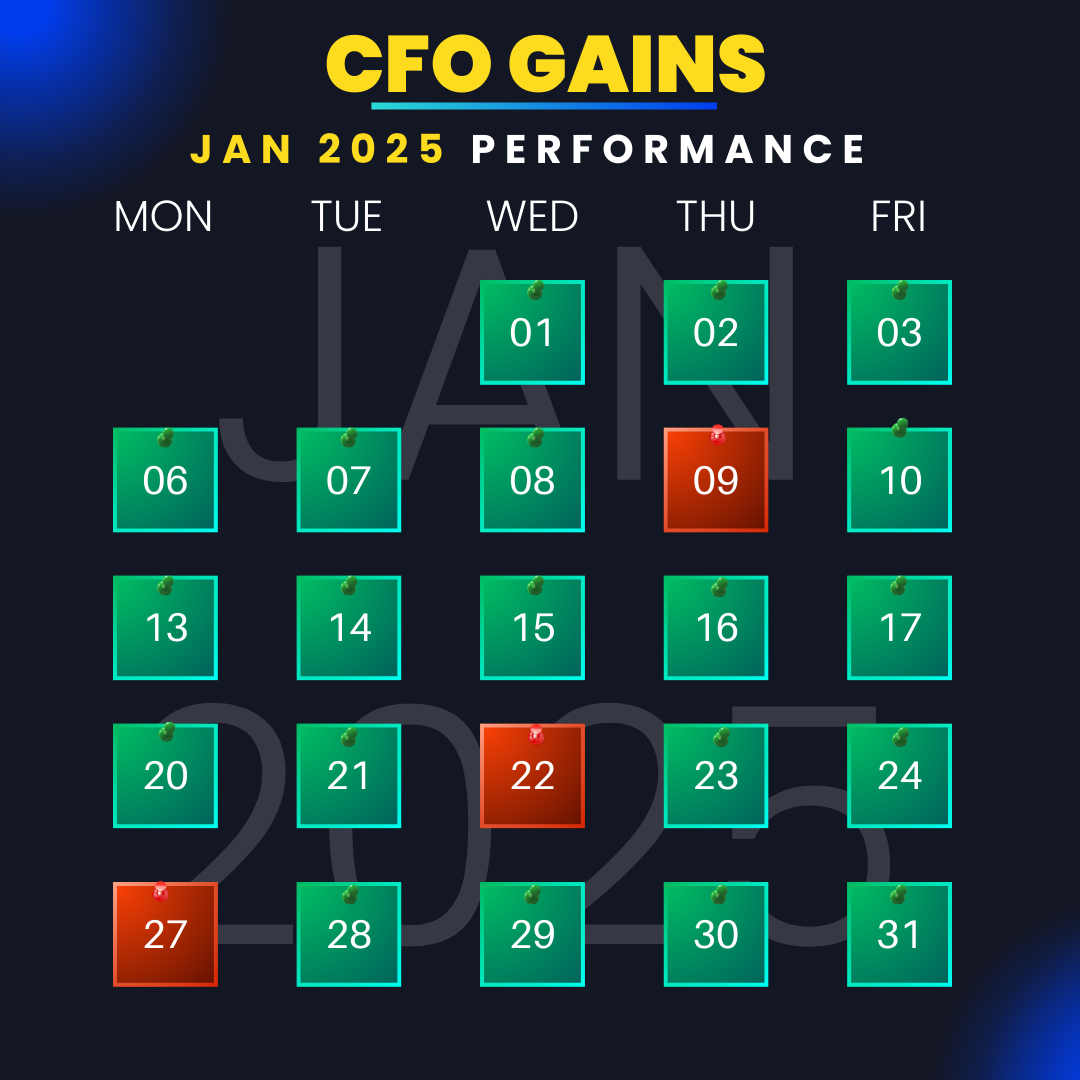

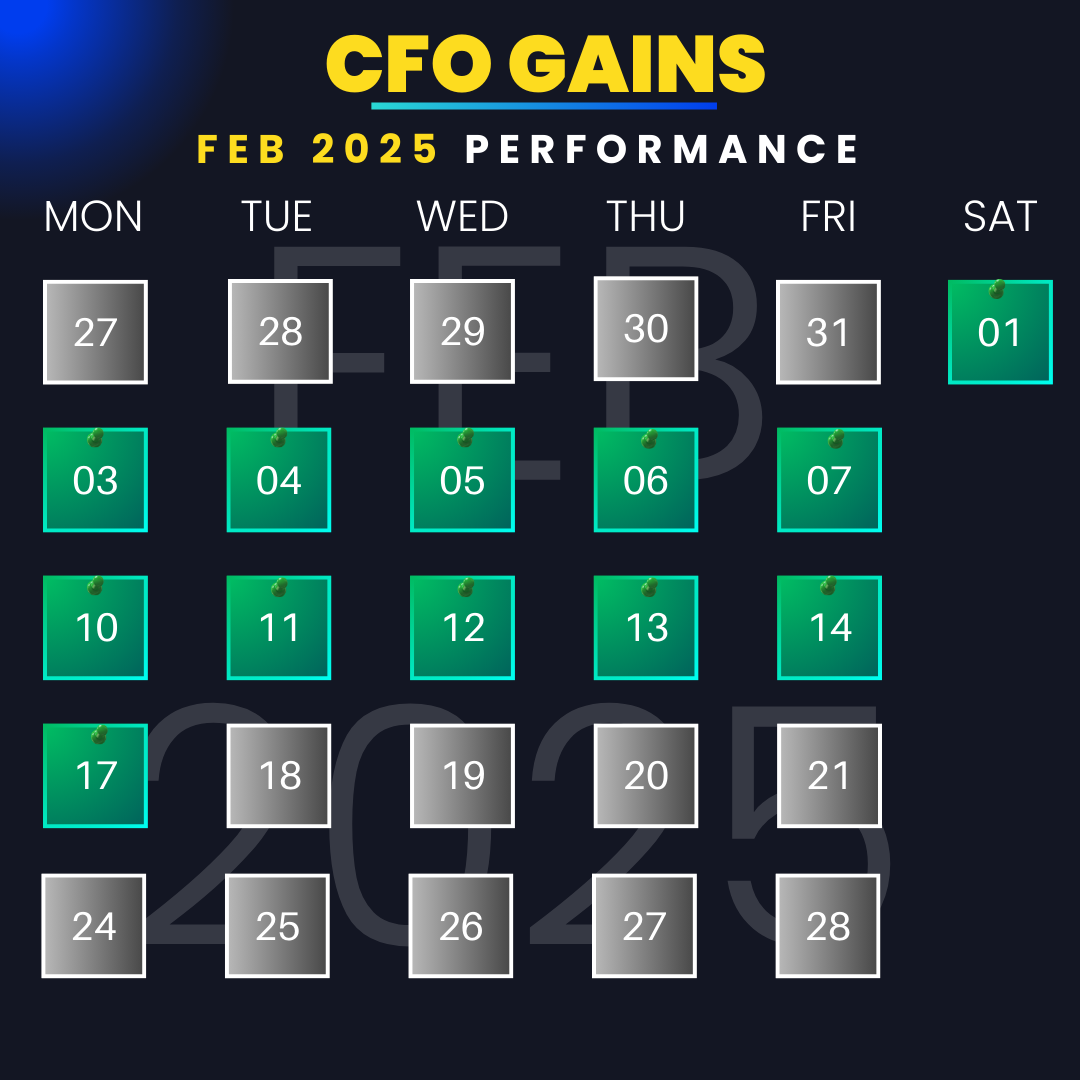

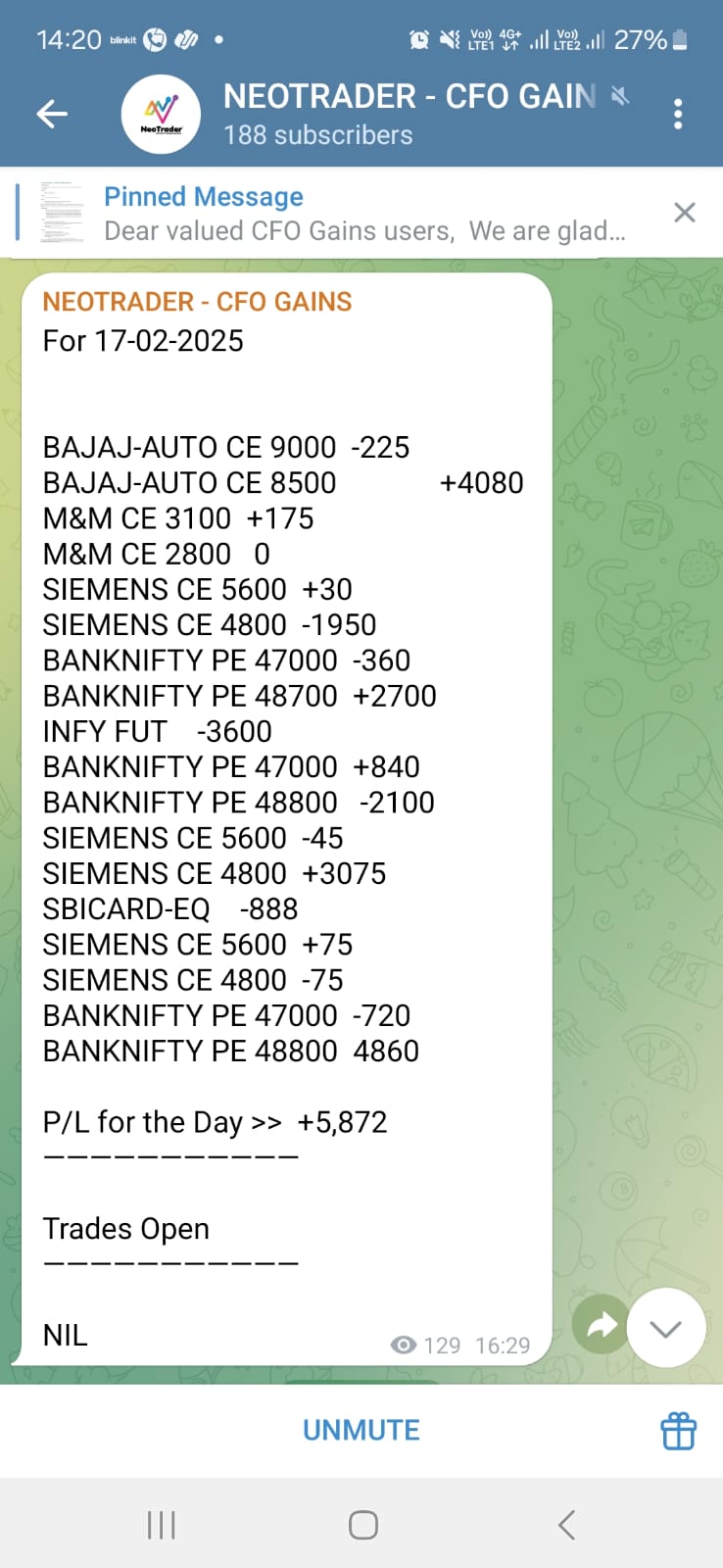

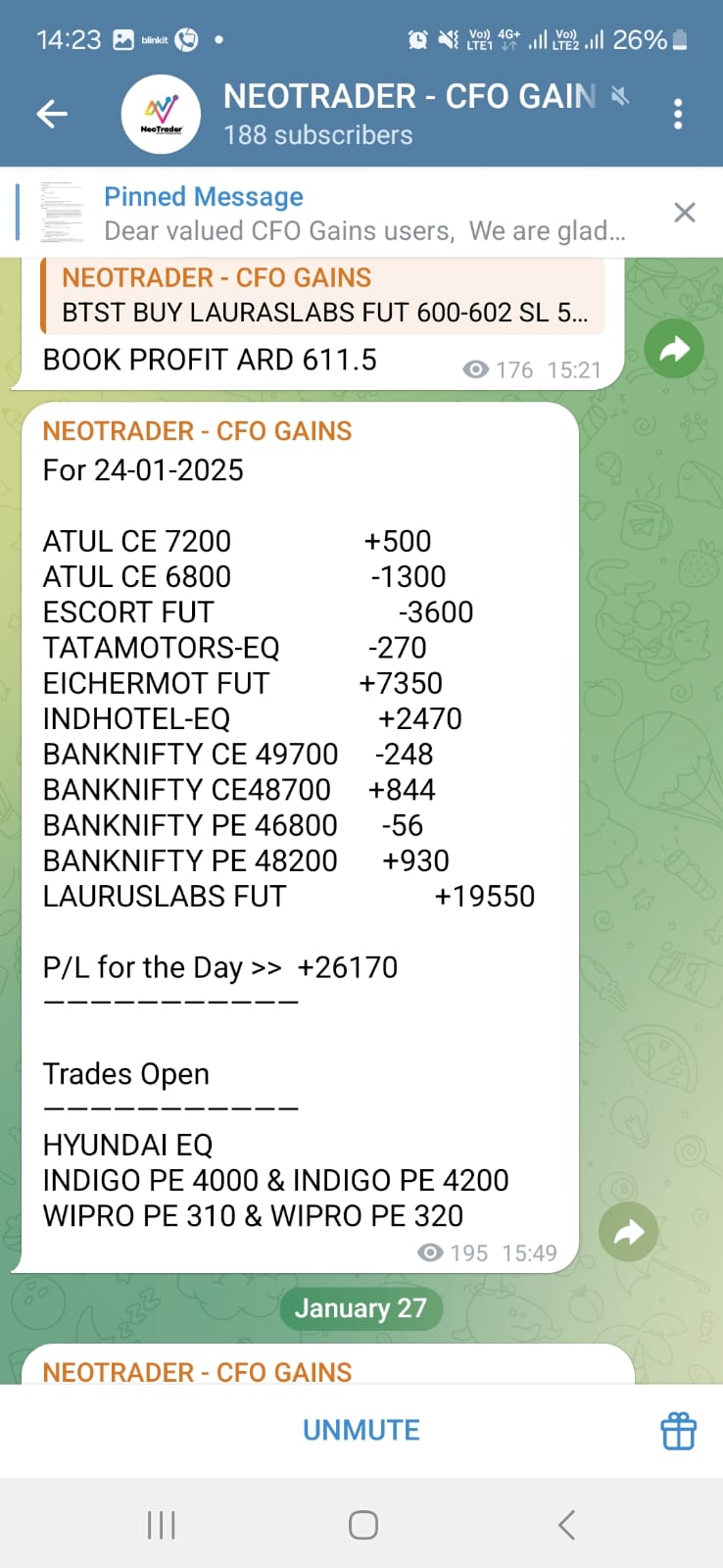

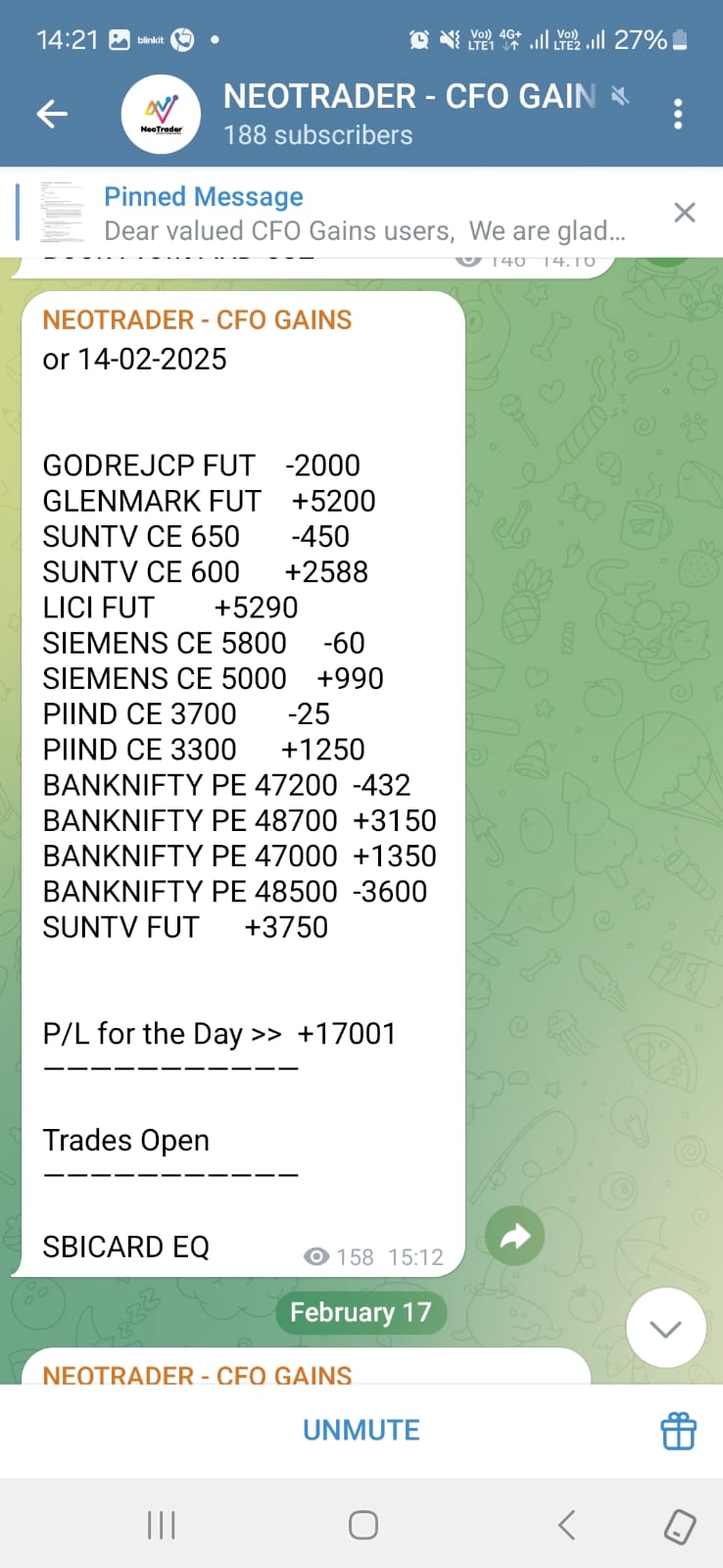

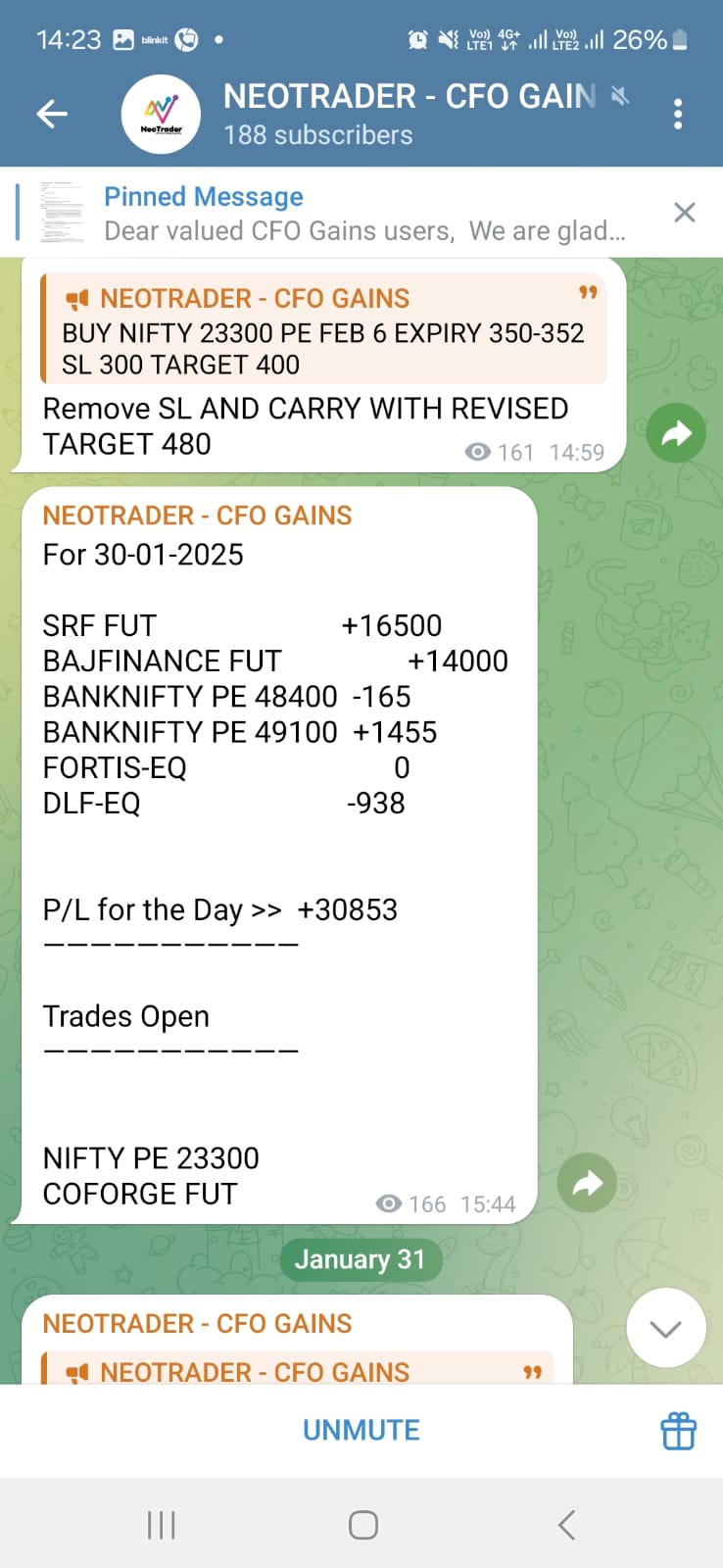

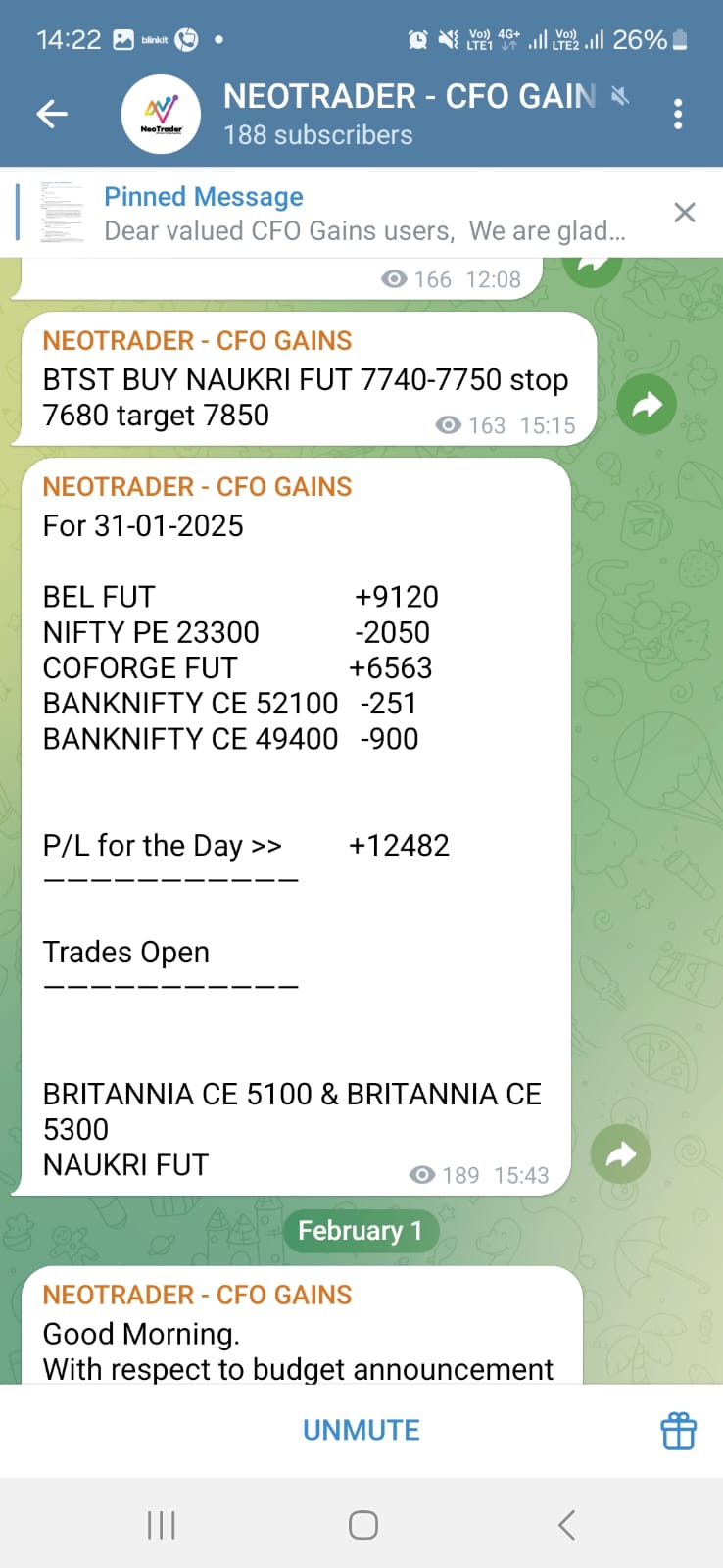

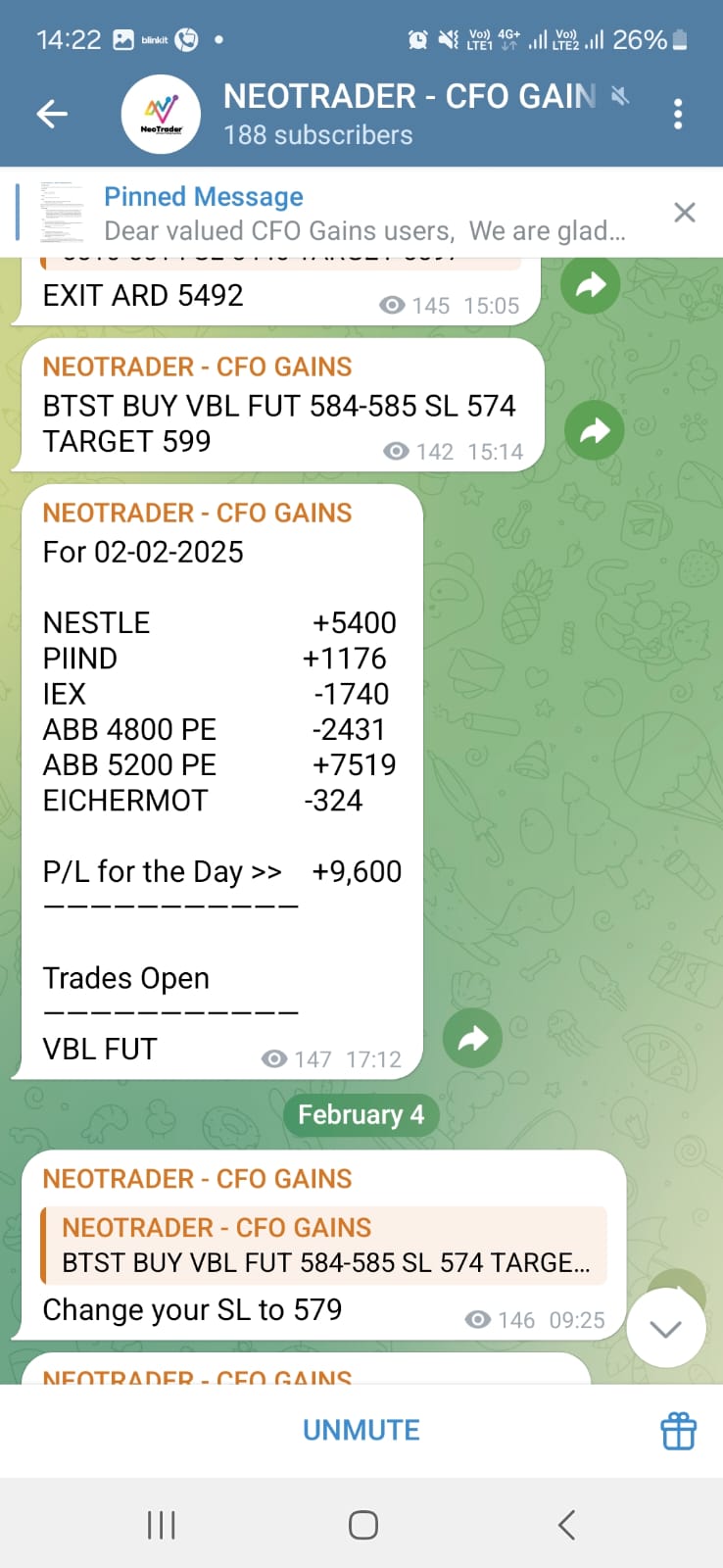

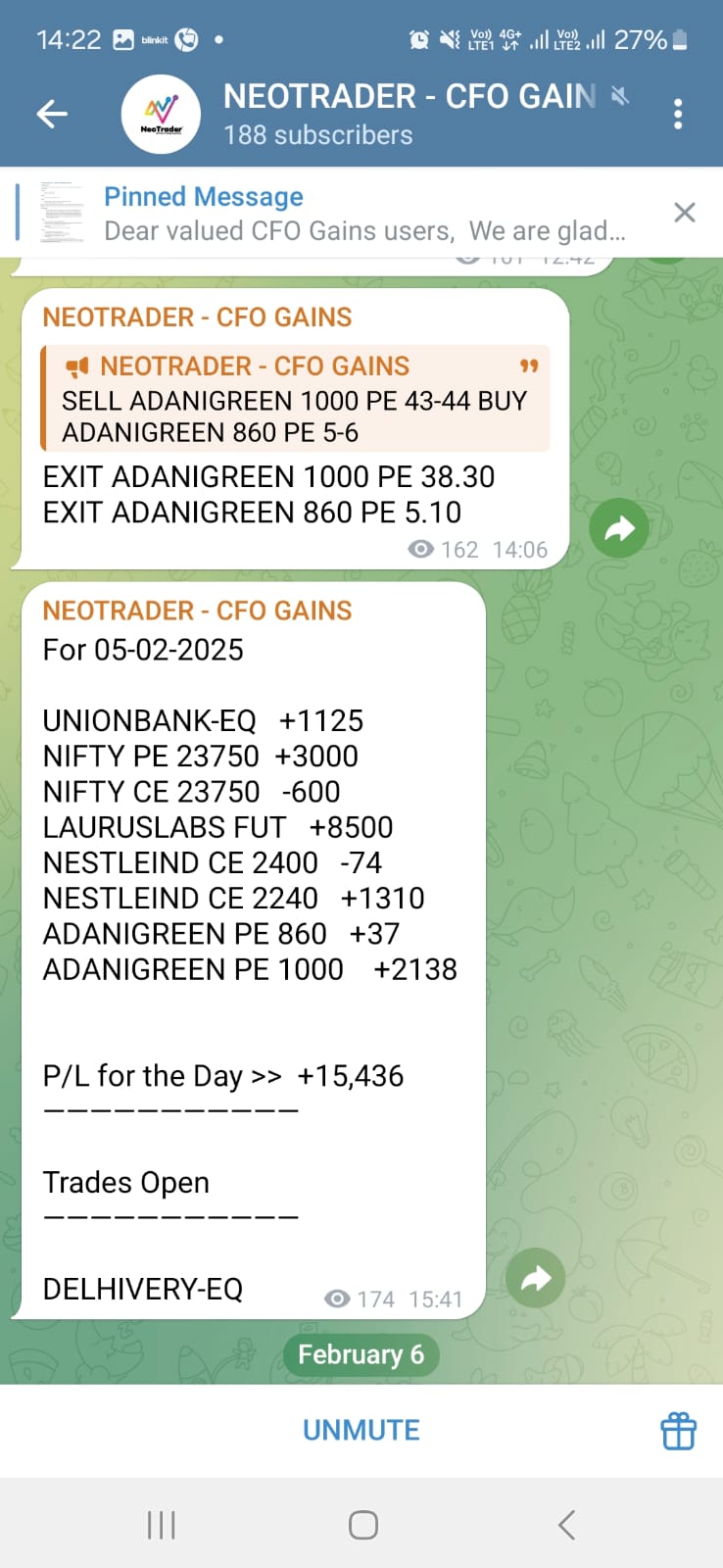

- Users get daily performance reports (EOD) for transparency.

- Trades follow pre-defined stop-loss and target levels for risk management.

FAQs

This is dummy text will be replaced with original content.

1. What is CFO Gains?

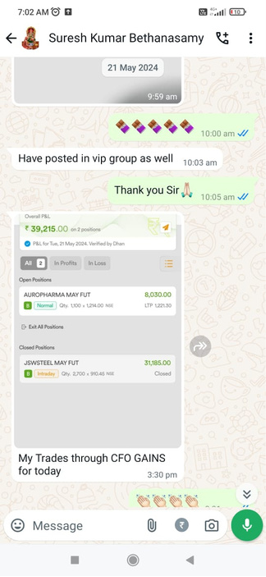

CFO Gains is a premium Telegram channel where we provide high-quality trade ideas across Cash, Futures, and Options categories. The trade calls are curated by our expert analysts and enhanced using AI-based insights to maximize profitability.

2. How much capital is required?

The capital requirement varies depending on the type of trades you choose:

- Cash Segment: ₹1,00,000

- Futures Segment: ₹1,50,000+

- Options Segment: ₹50,000+

these amounts ensure you can execute trades comfortably while managing risk.

3. How many trades will I get in each category?

We provide a balanced number of trades to maintain quality over quantity:

- Cash: 1-2 trades per day

- Futures: 1-2 trades per day

- Options: 2-3 trades per day

The exact number may vary based on market conditions.

4. What will be my average monthly returns from CFO Gains?

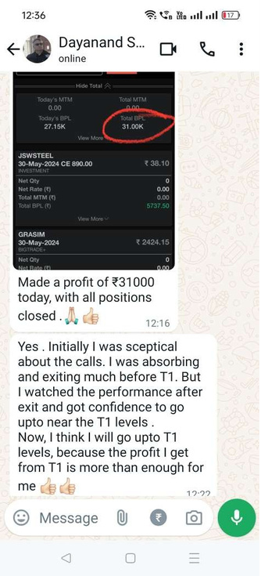

While past performance were stable and good, our strategy aims for consistent returns. On average, traders can expect 50,000+ monthly returns, depending on execution and market conditions.

5. I am a beginner in the stock market. Will CFO Gains benefit me?

Yes! Our calls come with clear entry, target, and stop-loss levels, making it easy for beginners to follow. Additionally, we provide regular insights to help you learn along the way.

6. How to join the Telegram channel?

After subscribing, you will receive a private invite link via email or WhatsApp. Simply click the link and join the group to start receiving trade ideas.

7. When will I start getting the trades?

Once you join, you will start receiving trade ideas immediately as per market conditions. Active trades are posted during market hours.

8. Do I need to take each & every given trade?

Not necessarily. You should choose trades based on your risk appetite, capital, and strategy. Our analysts provide the best opportunities, but risk management is key.

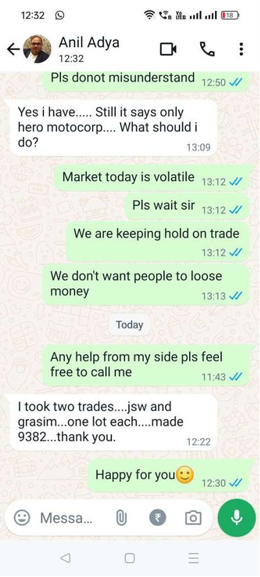

9. Post-subscription, will I get calling support?

We primarily provide support via whatsApp for quick and efficient responses. However, for premium users, we offer calling support for trade-related queries.